how to pay indiana state tax warrant

Claim a gambling loss on my Indiana return. Pay by telephone using.

Dentons Indiana Tax Developments Fall 2020

Know when I will receive my tax refund.

. Send in a payment by the due date with a check or money order. If you wish to dispute the amount owed please contact the Indiana Department of Revenue directly in Indianapolis at 317 232-2165 or their Merrillville branch located at 1411 E 85th Ave Merrillville IN 46410 219 769-4267. Tax warrants that remain unsatisfied are returned to the Department of Revenue for further action resulting in additional costs to the taxpayer.

Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Decide on your method of payment. INtax only remains available to file and pay the following tax obligations until July 8 2022.

Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website. As of the 2010 census the population was 2368139. No personal or business checks are accepted.

You have made arrangements to pay your tax liability. If you set up an IPA the warrant will remain on file. The Texas Warrant Roundup involves more than 300 jurisdictions state-wide with more than Largest Database of Montgomery County Mugshots.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. You owe less than 25000. You must pay your total warranted balance in full to satisfy your tax warrant.

Your debt will be paid off within 60 months under your installment agreement. In general you must meet the following criteria to qualify for these options. If you fail to pay your state taxes or resolve the past due balance within a reasonable time the tax bureau in your state likely will issue a tax warrant in your name.

Take the renters deduction. Unfortunately that approach doesnt work. Pay my tax bill in installments.

A tax warrant is a document that the department uses to establish the debt of a taxpayer. Instead of vanishing in to thin air neglected tax bills will turn into tax warrants. These should not be confused with county tax sales or a.

The lien encumbers all real and personal property used in the business and owned by the taxpayer. 734 views Sponsored by FinanceBuzz 8 clever moves when you have 1000 in the bank. When you use one of these options include your county and the mandate number.

Plan B is if you received a tax warrant by your countys sheriffs department for failure to pay your state taxes you must contact them immediately to avoid a court appearance. If you cant pay your tax debt in full you may be able to set up an installment payment agreement IPA to prevent additional collection action. Step 1-Walk up to Police Station Step 2-Show ID and ask if you have any warrants.

Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability. Find Indiana tax forms. Hamilton County Sheriffs Office 18100 Cumberland Road.

The Sheriff of Porter County is authorized to collect taxes due to the State of Indiana. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. 22-01-10-00033 Woody is a male Chihuahua born 312021 and weighs 6 12 pounds.

1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US Mail. You have made at least three direct debit payments under your installment agreement. Payment may be made in person at the Spencer County Sheriffs Office or by mail.

Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt. Doxpop provides access to over current and historical tax warrants in Indiana counties. Jan 22 2013 Bexar County San Antonio TX ID.

Weve put together a list of 8 money apps to get you on the path towards a bright financial future. Thats pretty much it. A tax warrant may be issued in Indiana when a taxpayer doesnt pay or respond to a tax bill.

Our service is available 24 hours a day 7 days a week from any location. How to Pay Indiana State Taxes Step 1. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill.

About Doxpop Tax Warrants. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2240 or visiting httpsintimedoringoveServices. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply.

This not only creates a public record of the tax debt but also creates a lien on your real and personal property such as cars homes and cash in your bank accounts. Learn More Related Answer Scott Elliott. We now have tax warrant data for the entire state of Indiana and this information can be searched from the Welcome Page or by clicking on the tax warrants tab.

You can pay with credit cards online or over the telephone. Tax Warrant Payment Methods. You can also pay.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax accounts in one convenient location 247. Dec 09 2021 A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Please arrange to pay by cashiers check money order or cash.

West Virginia police are furthermore supplied warrants in order to ensure court appearances for people who have ignored a subpoena or a court appearances. Mail - Payable to. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed.

When a tax warrant is filed with the Superior Court in the county where the taxpayer owns real or personal property a lien is created. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

We will also notify the Department of State that the tax warrant has been satisfied. Our information is updated as often as every ten minutes and is accessible 24 hours a day 7 days a week. It is not uncommon at all for taxpayers who are unable to pay a bill to simply ignore it and hope that it goes away.

Have more time to file my taxes and I think I will owe the Department.

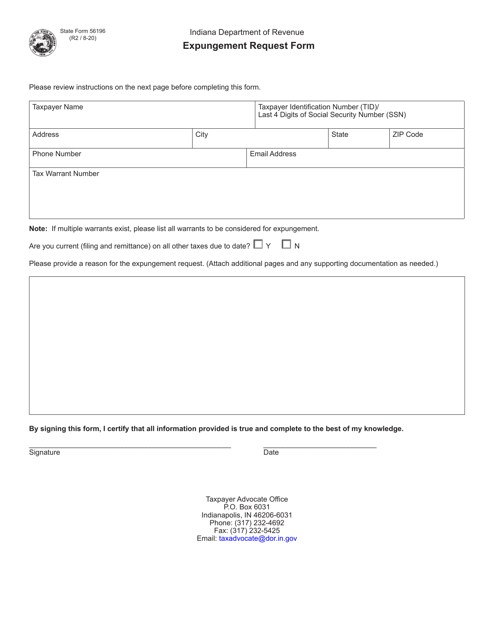

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Unfortunate But Familiar Indiana Dwd Warns Of Rise In Unemployment Fraud Wane 15

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Indiana Department Of Revenue Linkedin

Scam Alert Letter Being Sent That Threatens Property Seizure If Taxes Aren T Paid

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own

Dor Your State Tax Dollars At Work

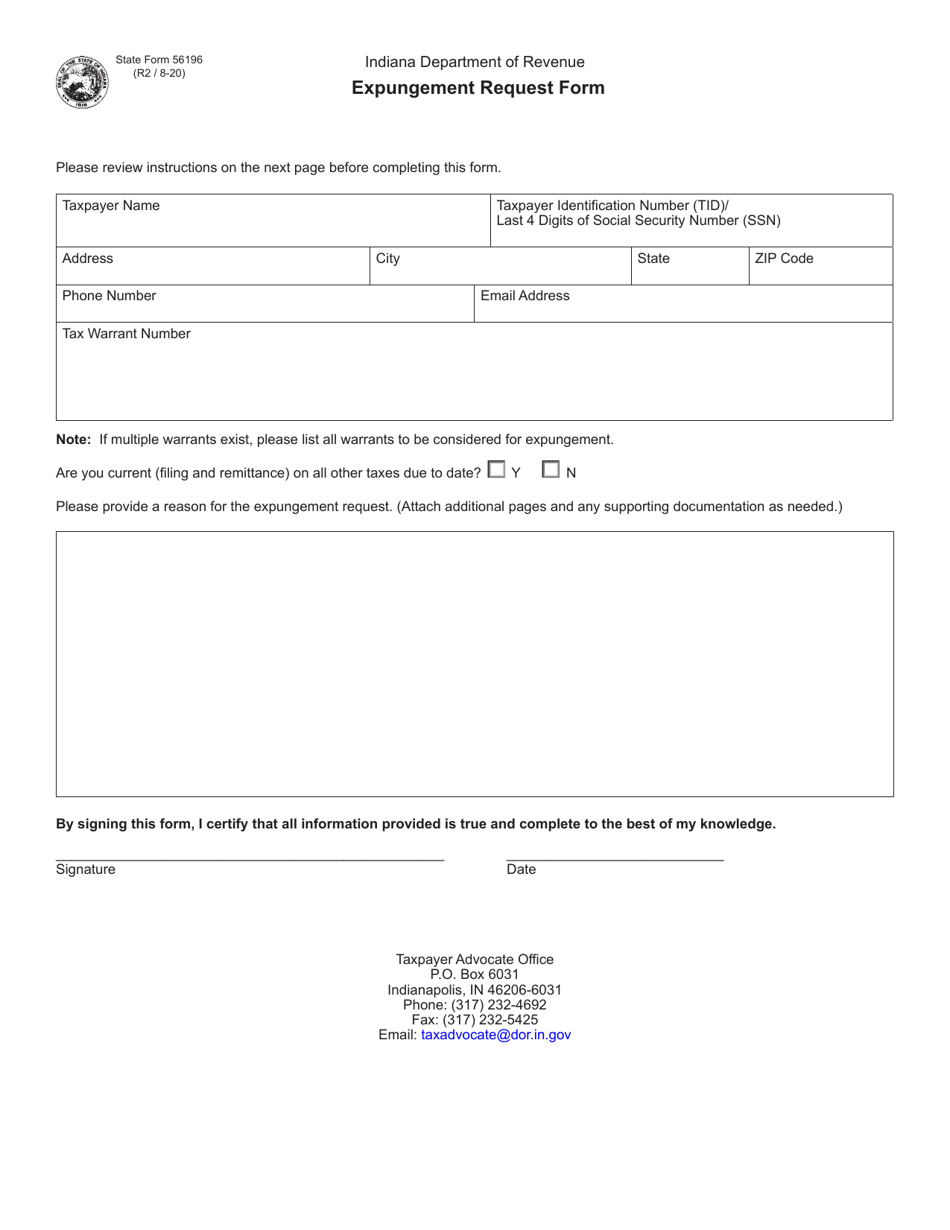

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant 2001 Templateroller

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Dor Act Quickly To Avoid Late Fees Or Penalties

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

Greenwood Police Warn Residents Of Tax Scam Fox 59

Dor Make Estimated Tax Payments Electronically

Indiana Dept Of Revenue Inrevenue Twitter

Dor Indiana Extends The Individual Filing And Payment Deadline